Orderbook-Pool Dashboard

This app lets you compare Uniswap pool prices and CEX orderbooks. It will also create a synthetic orderbook for 3-way comparisons on the CEX.

This app lets you compare Uniswap pool prices and CEX orderbooks. It will also create a synthetic orderbook for 3-way comparisons on the CEX.

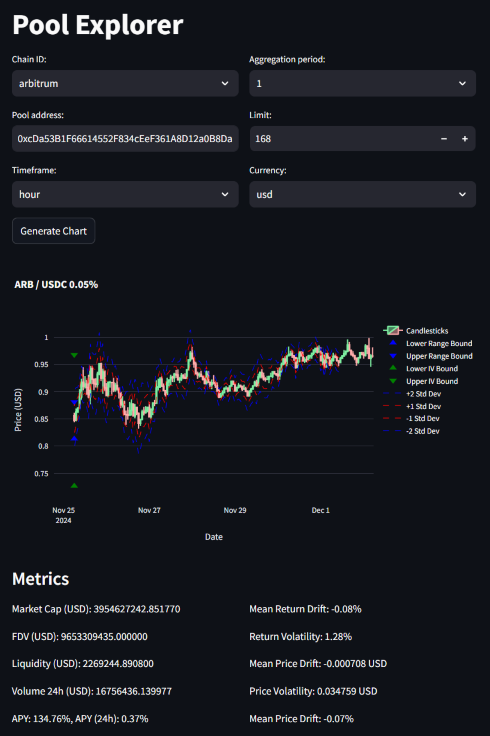

This app helps you explore Uniswap V3 pools, and compare many metrics and price data. It uses Monte Carlo simulations to estimate some interesting metrics like implied volatility and expected impermanent loss.

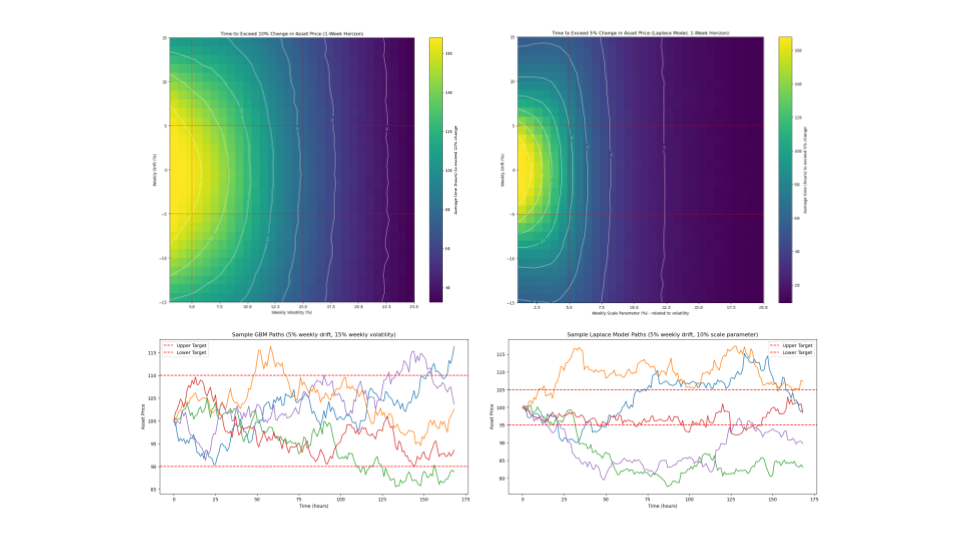

A Laplace distribution better captures the expected move for most Uniswap V3 pools and we can use this to predict how long we will be in a position on average given the drift and volatility.

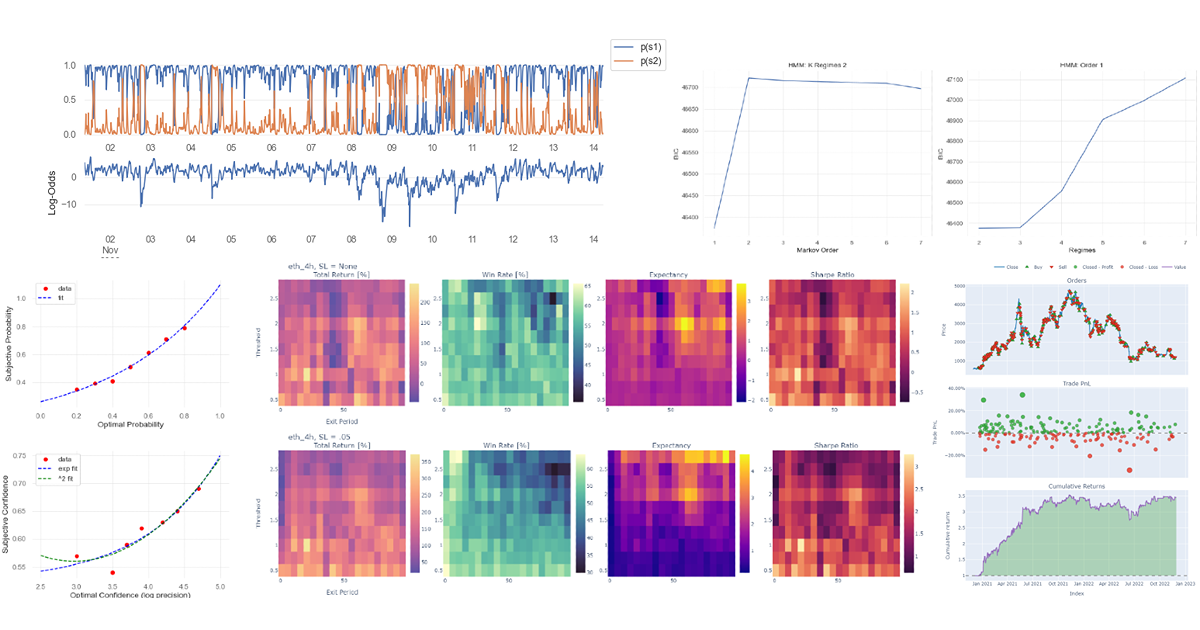

Using a regime-switching Hidden Markov model in conjunction with neuroscience data to capture traders’ bias we can better predict changes in market dynamics.

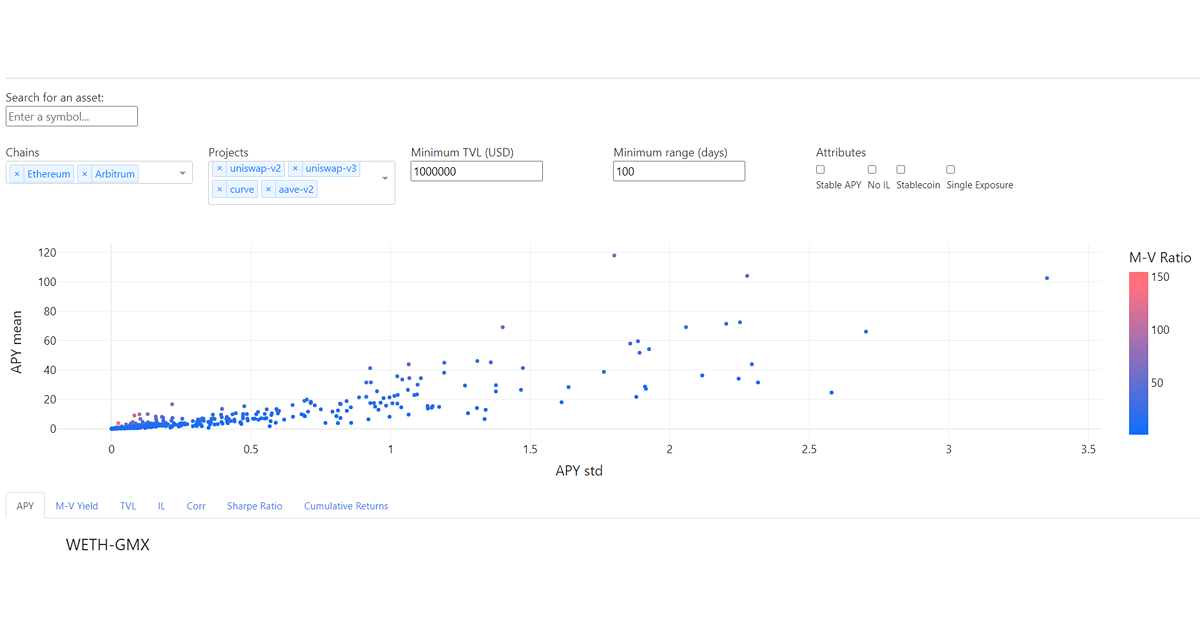

This app helps you find opportune DeFi yields given their risk-return, track their APY, TVL, and IL (etc.) over time, and forecast their future yields using ML.

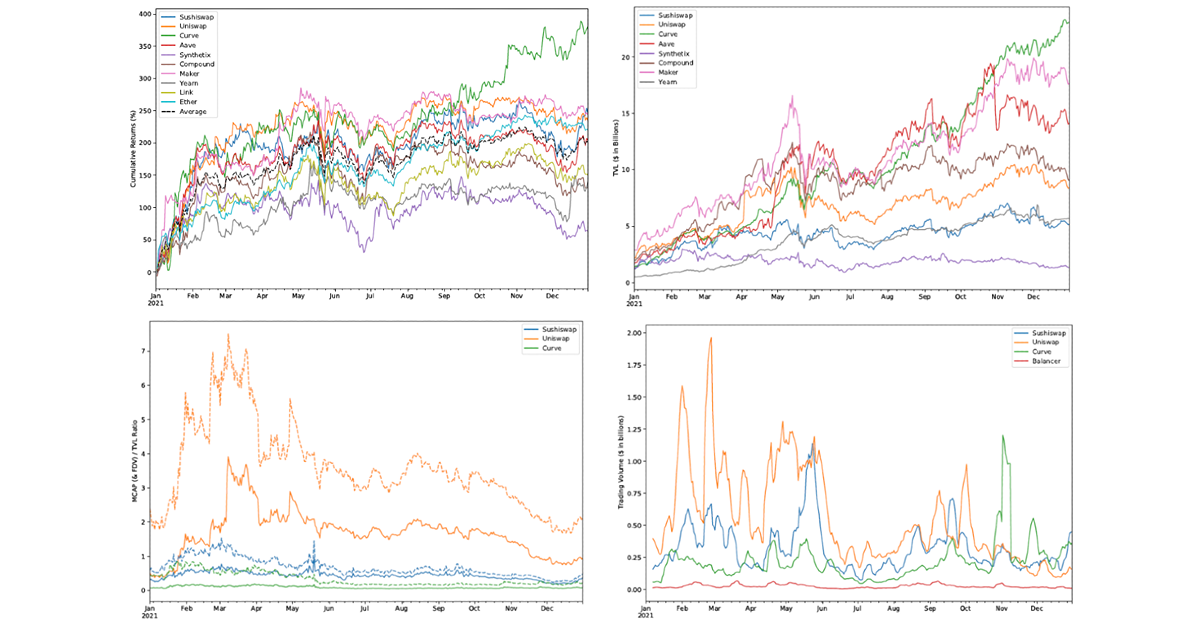

Long-form report on the Sushi protocol in 2021, historical data and future projections.

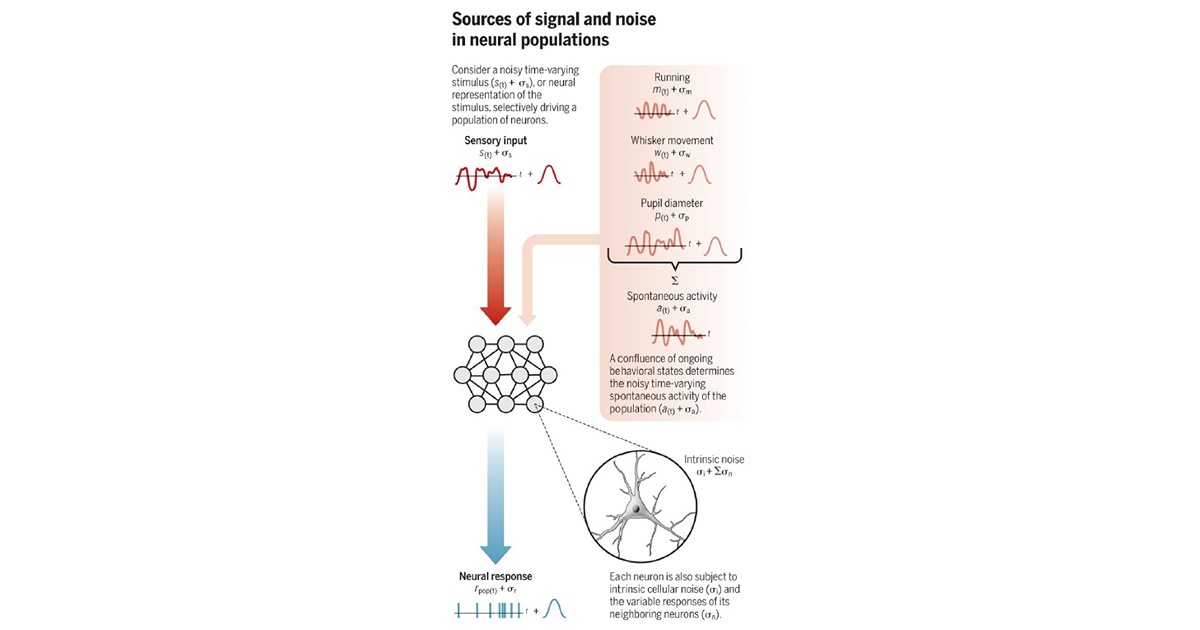

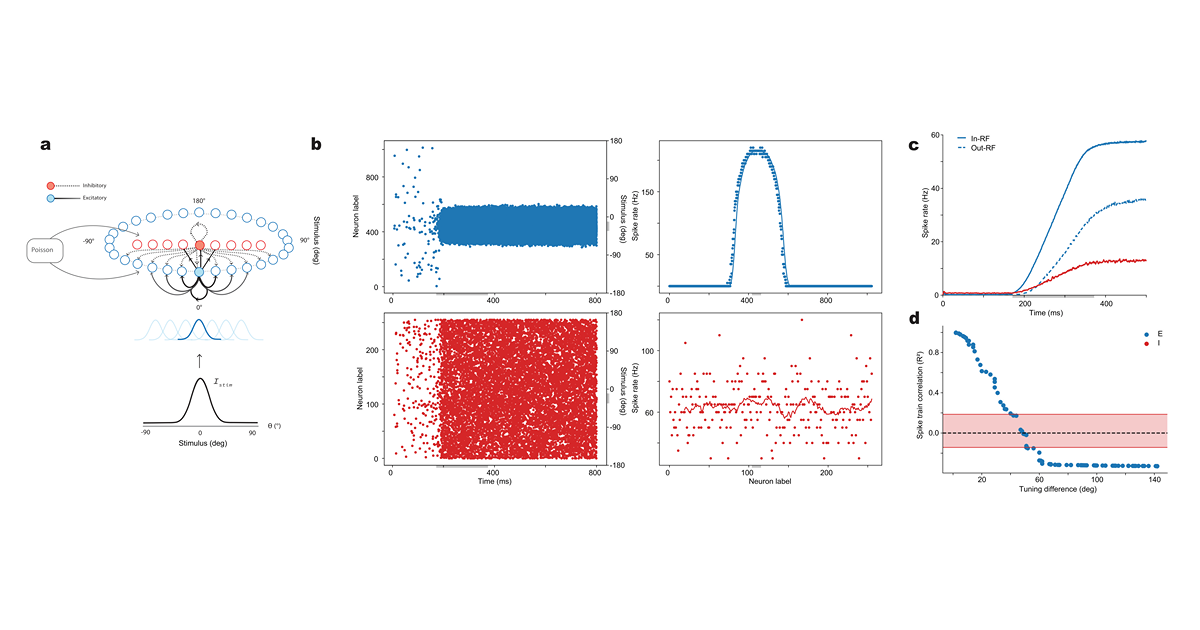

Attractor network dynamics that underlie persistent stimulus representations can be explained by the connectivity profile of excitatory and inhibitory neurons.

Neural dynamics during working memory reflect theoretical recurrent neural network models.

How do networks of neurons maintain information over short time scales?

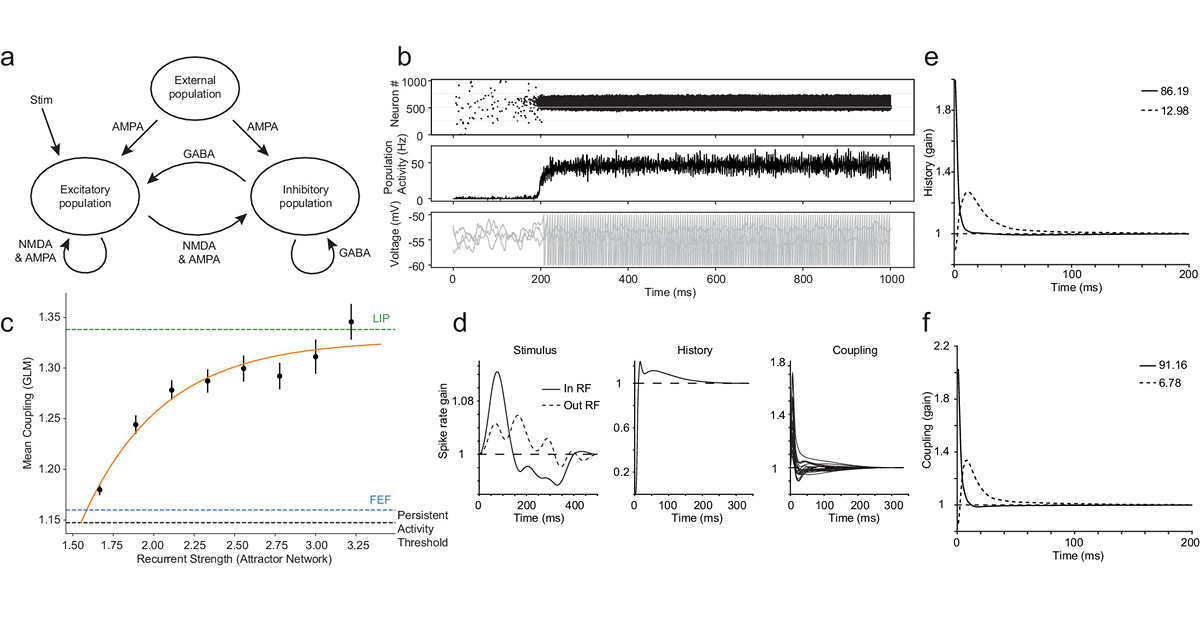

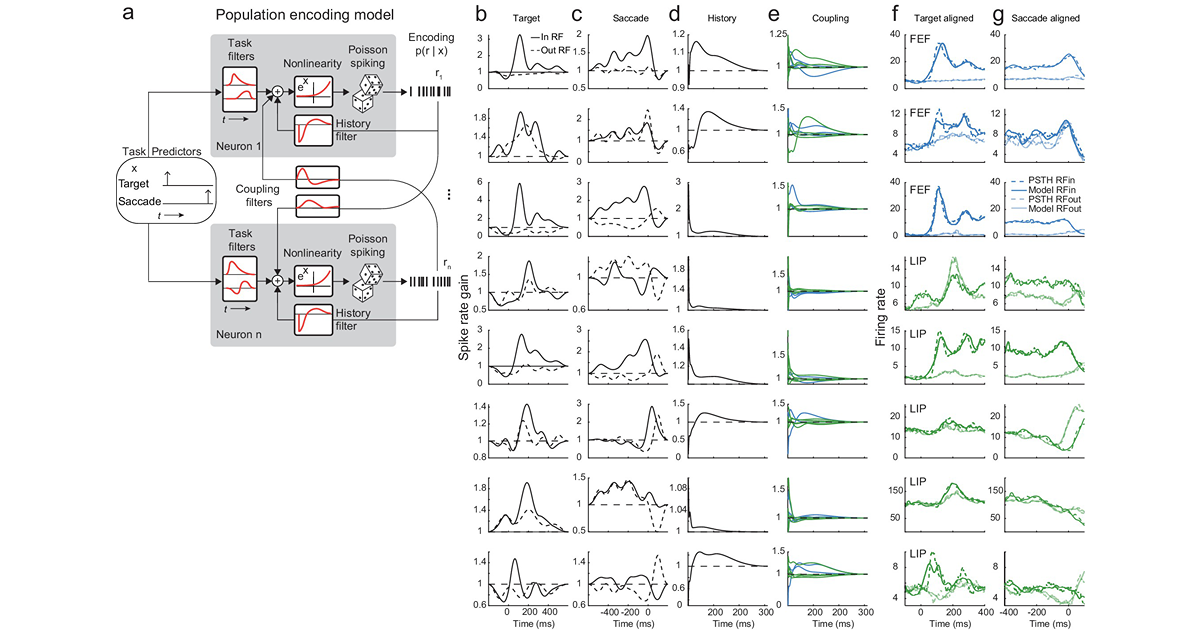

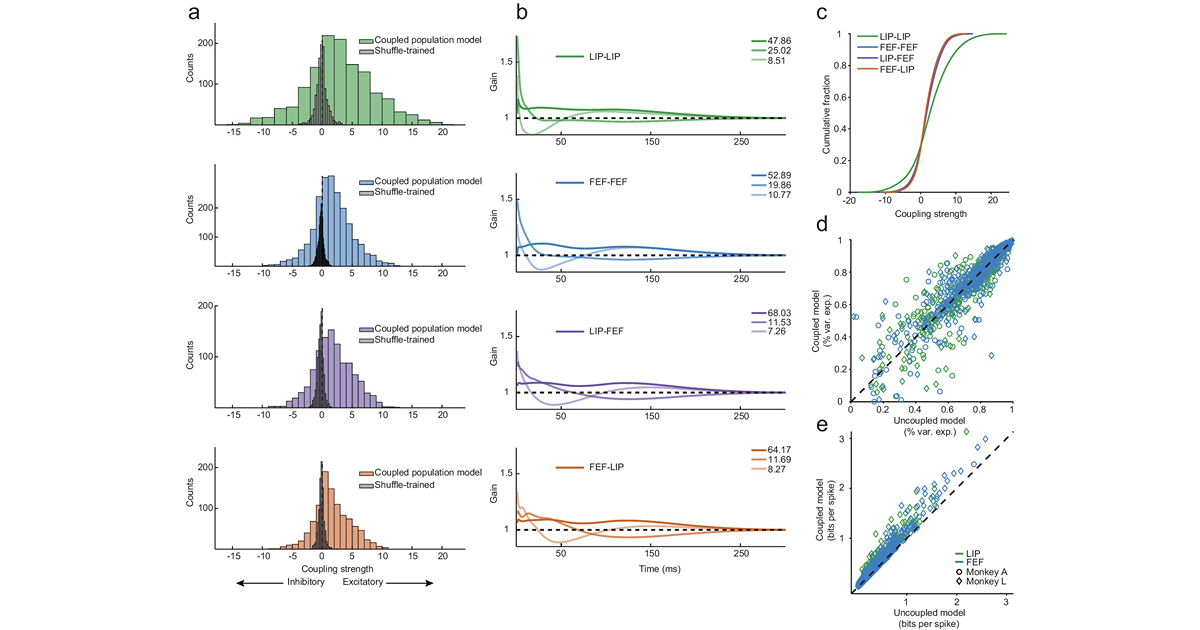

How does ongoing neural activity between brain regions support working memory and decision making?

Large-scale neural recordings reveal the sources of noise in the brain.